A trader who was able to short this pair has probably wondered how low it’d continue to go. One indicator that can help us determine where a trend might be ending is the Parabolic SAR . Now, it’s time for you to load up your charts and explore detailed applications. However, its effect kicks in later and is more significant for price swings that last longer. However, assuming that you are using the default Parabolic SAR parameters, I recommend starting with intermediate to slow settings between 50 to 200 for the EMA. This Parabolic SAR signal was the only one endorsed by the DM System on this chart.

- You might be standing firm in the open market for a critical time frame if the parabolic SAR is utilized inside a pattern or reversal setting.

- When it is positioned above the current price, it is deemed to be a bearish signal.

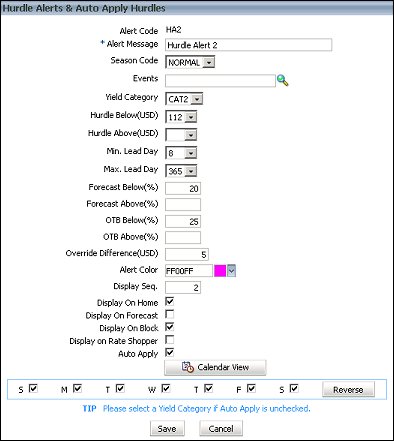

- It allows you to customize the colors of the dots for an uptrend and a downtrend separately and recognize the type of trending markets.

- The parabolic SAR indicator is used by traders to determine trend direction and potential reversals in price.

- This value is added to the prior SAR to find the current SAR.

If the market is choppy, the market is moving sideways, this tool does not particularly work at its best. Take a look at the Rabbit Trail Strategy if you are interested in trading sideways markets. A Bollinger Band® is a momentum indicator used in technical analysis that depicts two standard deviations above and below a simple moving average. This means that if the price is rising initially, but then moves sideways, the PSAR will keep rising despite the sideways movement in price.

Parabolic SAR Strategy for Day Traders

You have likely heard about indicators like moving averages, the average directional movement index, and standard deviation. These are very popular, especially if you watch financial media regularly. The major drawback of the indicator is that it will provide little analytical insight or good trade signals during sideways market conditions.

The stop loss you will place pips away from your entry. Always look for prior resistance or support to determine a stop loss. This trade would have been a +203 pip profit using the MA cross exit approach. In our example, a stop loss was placed 40 pips from entry.

Understanding the calculations behind the Parabolic SAR indicator can aid your understanding of how it works, what the various parameters mean and how to modify its usage. Stay on top of upcoming market-moving events with our customisable economic calendar. Thus you will witness a lot of whipsaws when the security is a non-trending mode. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.

Arrow trend indicators: trading strategies and advantages

The research was performed using three technical indicators; researched for 17 years. During the study, the Parabolic SAR is utilized as a stop-loss framework, not really as a trade marker. This is probably the easiest indicator to interpret because it assumes that the price is either going up or down. With that said, this tool is best used in markets that are trending, and that have long rallies and downturns. From the image above, you can see that the dots shift from being below the candles during the uptrend to above the candles when the trend reverses into a downtrend.

These false signals are especially prevalent in a choppy or sideways moving market. An unexpected spike slows the charts and disturbs parabolic SAR’s capability if persuading news stirs up valuations during a live trade. Should this happen, losses or unusual signals are potential how to use parabolic sar effectively outcomes. The trade is considered neutral during consolidation patterns or sideways action. Even the parabolic SAR shows dots above or below the price action. The vital component of parabolic SAR in cryptocurrency is perceiving when the dots get over the price.

In general, long trends tend to make more money than short trends. When an investor happens to catch a long trend, this is when profits are made. It is best to enter a trade at the start of a parabolic SAR trend.

” It will ultimately rely upon individual factors, such as your way of trading, the time you are trading, and your trading procedure. Through trial and error, you will want to find what parabolic SAR settings are best for you. However, the default values are the best spot to begin.

The parabolic SAR performs best in markets with a steady trend. In ranging markets, the parabolic SAR tends to whipsaw back and forth, generating false trading signals. Trending, trend direction, and prediction are valuable in determining a trade’s success. There is more meaning attributed to the trading terms we use every day. We shall know the importance of each term if we take the time to study, and this article focuses on the parabolic SAR.

You can perform the calculation with two parabolic SAR formulas. Although it is important to be able to identify new trends, it is equally important to be able to identify where a trend ends. Learn about crypto in a fun and easy-to-understand format. In our crypto guides, we explore bitcoin and other popular coins and tokens to help you better navigate the crypto jungle.

A dot below the price is deemed to be a bullish signal. Conversely, a dot above the price is used to illustrate that the bears are in control and that the momentum is likely to remain downward. When the dots flip, it indicates that a potential change in price direction is under way. For example, if the dots are above the price, when they flip below the price, it could signal a further rise in price.

You can choose different colors for the moving averages. The 20 period moving average is Red and the 40-period moving average is Green in this example. The difference between the uptrend and downtrend formula is whether the second part of the formula is added or subtracted.

Parabolic SAR trading strategies

It is an easy-to use indicator and one that you can use in combination with other indicators. First, the indicator is only used when the market is trending. It would be wrong to use it when the market is ranging. In this period, the results you will see will probably be wrong. First, you need to calculate the prior SAR,the extreme point, and the acceleration factor. However, it’s important to note that making the indicator faster may also increase the number of false signals.

If the resulting calculation puts the SAR above the previous day’s low or today’s low, the SAR value is capped at the lower of the previous day’s and today’s low. The investor plans to take profits at 50% of max profit. An investor sells a bull put spread with the short strike at this location at $3850. In this example of SPX, a signal to go long was given on March 29th.

The MetaTrader Supreme Edition is a plugin for both MetaTrader 4 and MetaTrader 5 that enables you to substantially expand the array of tools at your disposal. It even comes with a powerful ‘Trading Simulator’ that enables you to easily backtest your strategies and objectively measure their effectiveness. You can aim to improve your Parabolic SAR strategy by using other indicators to aid your decision-making. It’s important to note that the Parabolic SAR is not designed to work in a sideways market.

Using parabolic SAR as an active trader

Let’s consider how the indicator works through the example of Ethereum in a trending market. K is the step of price change, which by default is 0.02. We have two ways of adjusting the Parabolic SAR. One, we can adjust the step and two, we can adjust the maximum step. It is to be noted that from the formula shown above, the AF is multiplied by the difference between prior SAR and prior EP. This value is subtracted from the prior SAR to find the current SAR. The SAR can never be below the prior two periods’ highs.

thoughts on “How to use Parabolic SAR strategy Effectively”

This occurs during a downtrend when the price is coming down, making new lows. From the table above, you can see we have taken the SAR values on 23rd. We can see how the SAR value increased with new highs in the chart. The uptrend continued till the end and the SAR values increased with every new high made. It is to be noted that from the formula shown above, the AF is multiplied by the difference between prior EP and prior SAR. This value is added to the prior SAR to find the current SAR.

We will examine one adjustment we can make to better filter out the trades to take. We definitely recommend it as a way to judge where to place stop-losses, but urge traders to use other tools alongside the Parabolic SAR to prevent false signals and fakeouts. The first of which being that it helps to determine a trends direction and potential reversals in price. Traders additionally utilize the parabolic SAR dots to set trailing stop loss orders.